![]() Thank sir DJ.. Magaling na sales and he understand the client.. Positive feedback on you sir..

Thank sir DJ.. Magaling na sales and he understand the client.. Positive feedback on you sir..

Tired of LOW EARNINGS of your Money in TIME DEPOSIT?

Ad Information

Ad Description

PHILAM LIFE

Money Tree

With a minimum investment of P500,000 let Philam Life

manage your money and grow it for you!

GROW YOUR MONEY BY 15% or EVEN HIGHER!

THE BEST INVESTMENT is the one that BEATS INFLATION!

Do not let your money sleep in the bank earning 0.375%,

INVEST IT IN PHILAM LIFE's MONEY TREE TODAY!

Contact me for a FREE Financing Coaching and Assessment

CALL or Text me NOW.

Globe: +63.9154233799

Smart: +63.9284063994

Sun: +63.9228111086

Landline: +632.3464387

Email: takehome@driven-group.com

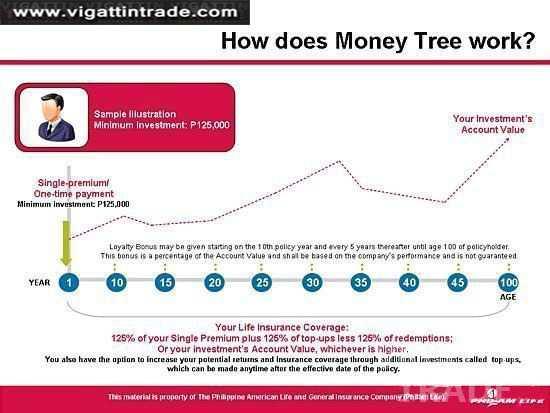

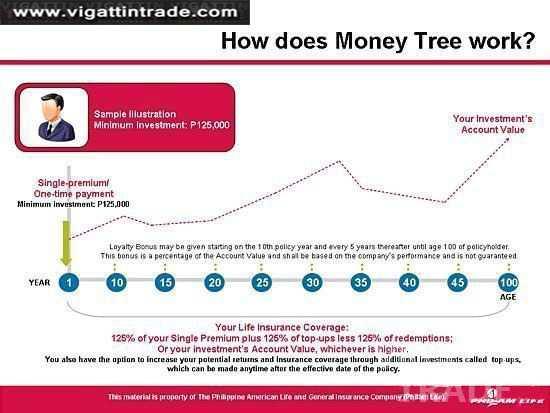

Money Tree is a one-pay investment and life insurance plan that can earn more than bank deposits in the long-term.

It maximizes your money’s growth potential by giving you the opportunity to invest in high-performing funds in the Philippines which is now the 4th fastest growing economy in Asia1 and projected to be the 6th out of the 196 countries in the world2. Since launch, Money Tree funds have earned 8% to 15%3 yearly. And unlike bank deposits, Money Tree offers guaranteed life protection equivalent to 125% of your investment to further secure your family’s future.

Grow your money’s value over the long term

- Go for investments that offer returns higher than inflation to grow your money over time. Bank deposits currently earn 2.75% or less4 annually, while inflation is at 3.6%5.

Ride on the growth of the Philippine economy

- Gain access to an array of professionally-managed investment funds which allow you to participate in the growth sectors of the Philippine economy.

Gain from Professional Fund Management

- Benefit from Philam Life’s expertise and experience in insurance and wealth management to help you grow your money over the long term.

Enjoy Guaranteed Life Insurance

- Protect yourself and your family with guaranteed life insurance benefit of at least 125% of your initial investment.

So don’t let your money sleep. Grow it with Money Tree!

1 Bloomberg, 2Q 2012 Real GDP % YoY Growth

2 Knight Frank and Citi Private Bank, The Wealth Report 2012

3 Annualized returns of Money Tree funds since launch until September 28, 2012

4 Investment rates of the top 3 banks as of October 18, 2012

5 Inflation rate as of September 2012

|

CALL or TEXT me NOW.

DJ Dimaliuat

Philam Life

|

YOUR TRUSTED FINANCIAL COACH  DJ Dimaliuat |

|||

GLOBE: +63.915.4233799 |

||||

SMART: +63.928.406.3994 |

||||

|

I'm also in VIBER! +639228111086 |

dj.takehome

BBM: 29EB7122

Facebook: www.facebook.com/djdimaliuat |

Mr. Shane Lizaso’s Testimonial of DJ’s service |

Mr. Khaze of Jeddah’s positive feedback for DJ

Mr. DJ is a very good agent especially sa ofw’s tulad ko sya ang naghandle ng first condo ko at wla akong masabi excellent madali lang syang macontact kahit saan pakayo sulok ng mundo ksi laging nakaonline magsend ka lang ng message sa kanya ontime sagot agad.I recommend DJ for OFW’s |

|

Below are common Frequently-Asked-Questions (FAQs) about Money Tree that we have compiled for your reference.

Q: What is Money Tree?

A: Money Tree is a peso-denominated, single premium (one-pay) variable life insurance product that allows the policyholder/ insured to participate in the potentially high returns of the financial markets by providing the following wide array of investment funds that will cater to the risk-appetite of the client:

- Philam Life Fixed Income Fund (PFIF)

- Philam Life Balanced Fund (PBF)

- Philam Life Equity Fund (PEF)

Q: What is the composition of these funds?

A: For better perspective, here are the composition of these funds:

- Philam Life Fixed Income Fund – This fund invests primarily in high-grade interest-bearing bonds that present low to moderate levels of risk. It aims to provide a stable return over the medium- to long-term, and preserve capital by investing primarily in fixed-income securities issued by the government and reputable corporate issuers.

- Philam Life Balanced Fund – This fund contains a balanced investment in performing bonds and equities available in the market. This fund is for the policyholder with an investment objective of long-term capital appreciation by investing in equities, equity-related securities and debt securities

- Philam Life Equity Fund – This fund is for the policyholder with an investment objective of capital appreciation over a long-term investment horizon, and the risk appetite for the stock market. Its objective is to achieve capital growth by investing in an efficient and diversified portfolio of predominantly growth companies, while including appropriate value stocks.

Q: Can I add to or withdraw my investments?

A: With Money Tree you have the flexibility to make additional investment or top-ups, or switch investments from one fund to another as you deem best. You have also convenient access to your money through partial or full withdrawals of your account

Q: How will I know how much my account value is?

A: Philam Life will send you a Statement of Account at least on an annual basis. Aside from this, you can check your fund’s Net Asset Value Per Unit (NAVPU) anytime through our Fund Performance Section or through our VUL Customer Hotline (02) 528-2028.

Compared Ad